Unlocking Hong Kong's Financial Future Through Tokenization

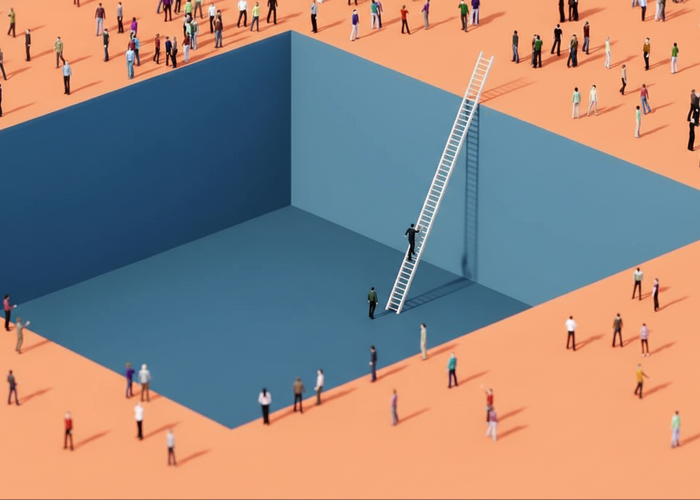

I've always been intrigued by how innovative tech can transform traditional sectors, and this BCG white paper on tokenizing Hong Kong's fund industry hits right at that sweet spot. Collaborating with Aptos Labs and Hang Seng Bank, the report highlights how shifting to tokenized systems could potentially double the market's size by modernizing outdated infrastructure.

Drawing from the Hong Kong Monetary Authority's e-HKD+ pilot, it breaks down adoption drivers into three key areas: regulatory preparedness, operational features, and business feasibility. What stands out to me are the practical perks—slashing counterparty risks, cutting costs, and providing round-the-clock liquidity that keeps things flowing smoothly.

Even more compelling is the investor pulse: a survey of 500 retail folks showed over 60% ready to boost investments in tokenized options, with nearly all eyeing benefits like instant settlements and always-on access. It's a clear signal that demand is there, waiting for the right infrastructure and rules to catch up.

This piece underscores the momentum building in digital finance—perfect for anyone watching global investment trends. Check out the full white paper to explore how these shifts could redefine opportunities in the region.

Working with investors and entrepreneurs to gain the best ROI possible.

Expanding into retail doesn't have to be terrifying. Discover six practical tips from a founder's...

Discover the quiet crisis hitting founders after 40 and how to turn it into a leadership strength.

Uncover the quiet crisis many midlife entrepreneurs face and the shifts to reclaim purpose and le...

BigHaat raises $10M to revolutionize farmer-focused agritech and sustainable supply chains.

Rising health premiums got you stressed? A founder's playbook for balancing costs and employee ca...

BigHaat's $10M funding fuels digital tools and sustainable farming practices for Indian farmers.