Image credits to MarketWatch.com

For investors looking for potentially oversized returns, Alumni Ventures suggests investigating the private markets with an eye on pre-seed and seed-stage venture capital. Industry Ventures concurs, finding data from Cambridge Associates to show the average net annual returns for early-stage funds as 21.

For investors looking for potentially oversized returns, Alumni Ventures suggests investigating the private markets with an eye on pre-seed and seed-stage venture capital. Industry Ventures concurs, finding data from Cambridge Associates to show the average net annual returns for early-stage funds as 21.

For investors looking for potentially oversized returns, Alumni Ventures suggests investigating the private markets with an eye on pre-seed and seed-stage venture capital. Industry Ventures concurs, finding data from Cambridge Associates to show the average net annual returns for early-stage funds as 21.

For investors looking for potentially oversized returns, Alumni Ventures suggests investigating the private markets with an eye on pre-seed and seed-stage venture capital. Industry Ventures concurs, finding data from Cambridge Associates to show the average net annual returns for early-stage funds as 21.

This post has originally been written by MarketWatch.com on Tue, Feb 14, 23. Find the original post here at MarketWatch.com

Connie Harrell

Working with investors and entrepreneurs to gain the best ROI possible.

Related Posts

Lash Extensions From An AI Robot: Is This The F...

Exploring the revolutionary intersection of AI and beauty with LUUM Lash - the future of eyelash ...

$20M Fund For Connecting Early-Stage Israeli St...

Discover how 97212 Ventures is pioneering the fusion of Israeli innovation with New York's dynami...

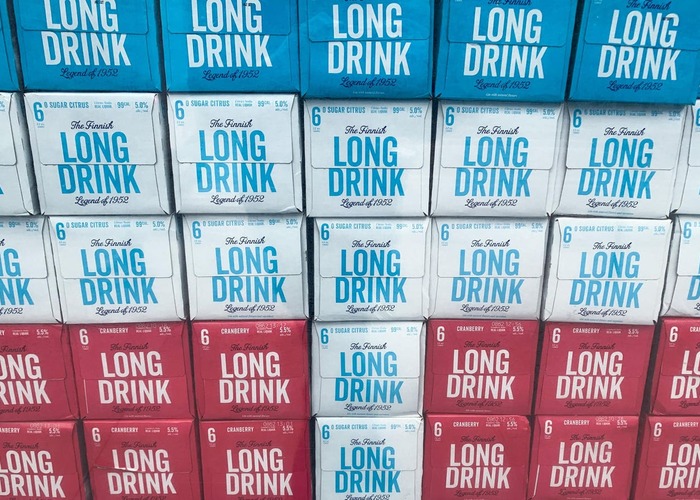

Jay-Z’s Venture Capital Firm Invests In Popular...

Jay-Z's MVP bets big on The Finnish Long Drink, fueling the RTD cocktail market's expansion. Dive...

Can this new community hub provide a spark for ...

Discover how Seattle Foundations is shaping a new era for entrepreneurs with a unique, community-...

At Max Altman’s Saga Ventures, An Unlikely Trio...

Discover how Saga Ventures is redefining venture capital, aiming to connect tech innovation with ...

Solo GP fund Andrena Ventures hopes to carry st...

Discover how Andrena Ventures is nurturing the next wave of startups, straight from the heart of ...

0 comments