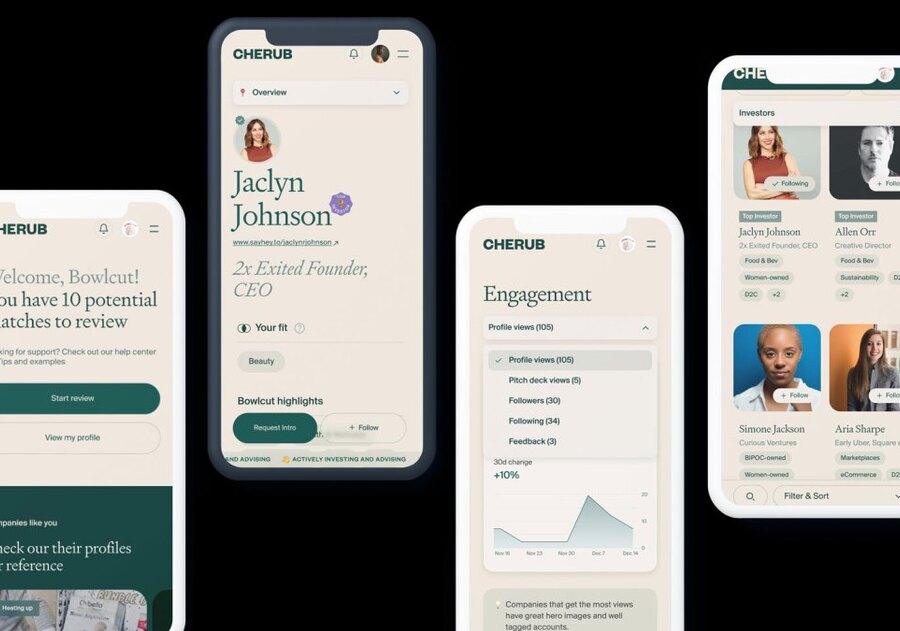

Delving into the realm of angel investing and entrepreneurial connections, the inception of Cherub presents a fascinating narrative. Co-founders Jaclyn Johnson and Angeline Vuong have crafted an innovative platform, likened to the exclusivity and precision matching of a dating app, but for the business world. As an entrepreneur and investor myself, I find the concept of Cherub intriguing for its fresh approach to bridging the gap between angel investors and entrepreneurs. Specifically, the platform's unique methodology, leveraging preferences to match founders with investors, stands out as a strategic pivot from traditional investment methods.

Cherub's early success, highlighted by the quick uptake of its newsletter and alpha product, underscores a substantial market need for such connective platforms. Its membership model, although not unprecedented, includes thoughtful features that actively support startups in getting noticed by potential investors. This aspect resonates with me, emphasizing how critical visibility and presentation are in the early stages of fundraising.

However, while Cherub distinguishes itself with a focus on consumer packaged goods (CPG) and a mix of various industries, it is essential to reflect on how it positions itself against established platforms like AngelList. The blend of social interaction through mixed networking events further enriches the Cherub experience, showing that investment is not just transactional but also relational.

In wrapping up, Cherub's novel approach, notably its social and personalized investment matching system, adds a refreshing dimension to the startup and investment ecosystem. It leverages a combination of technology, personal interaction, and strategic market positioning to facilitate meaningful connections. For those navigating the complexities of angel investing and startup funding, exploring a platform like Cherub could unveil new opportunities. It is indeed an inspiring venture worth following.

Working with investors and entrepreneurs to gain the best ROI possible.

Niko Bonatsos leaves General Catalyst to start a new VC firm focused on young founders and consum...

Decisiveness isn't innate—it's a skill leaders build through emotional steadiness, future vision,...

UK VC in 2026: AI and deep tech boom amid cautious fundraising and a push for liquidity—opportuni...

Discover what early-stage investors really want from first-time founders: clear communication, st...

VCs are kingmaking AI ERP startups with massive early funding, even on low revenue. A new power p...

Gemba Capital's playbook for backing India's fintech and consumer tech innovators at the earliest...