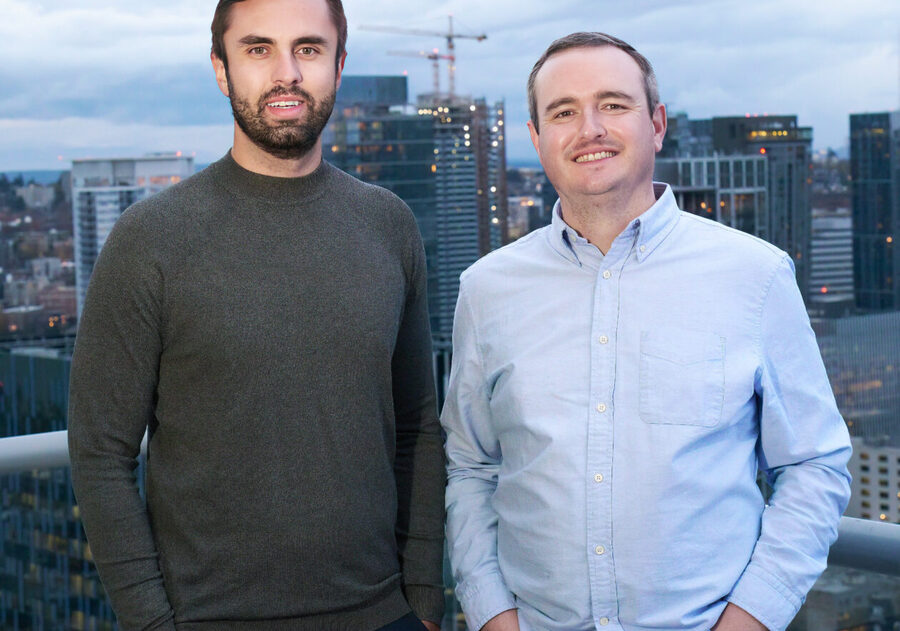

As a proponent for nurturing early-stage innovation within our vibrant Pacific Northwest tech ecosystem, I find the emergence of Breakwater Ventures particularly noteworthy. Spearheaded by the seasoned trio of William Finney, Peter Mueller, and Lauren Olson—alumni of SeaChange—this new Seattle-based investment firm is poised to make a significant impact. With a focus on pre-seed and seed funding, Breakwater embarks with a robust $10 million initial fund, keen on championing software startups that are in the critical infancy stage of their development.

What sets Breakwater apart is not just its commitment to filling the substantial need for initial capital—echoing a persistent concern within our community—it's their strategic decision to forego the 'collaborative investor network' model previously employed at SeaChange. Instead, they're innovating with a post-investment engagement platform designed to bridge the gap between portfolio companies and a wealth of resources.

Though Breakwater Ventures is unabashedly Pacific Northwest in focus, it's prepared to extend its reach to exceptional startups outside the region as well. Targeting sectors such as data/AI, enterprise, fintech, and marketplaces with check sizes between $250,000 to $1 million, their approach is poised to catalyze the growth of tomorrow's tech leaders. As someone passionate about supporting nascent technology ventures, I see Breakwater's emergence as a beacon of hope during a time when the capital markets are tight and the entrepreneurial spirit needs nurturing more than ever.

For my fellow entrepreneurs and investors, diving into the details of Breakwater Ventures' strategy and vision could offer invaluable insights into the future of startup investment. It's a testament to the belief that even during periods of financial restraint, there are entities ready to back groundbreaking ideas.

Working with investors and entrepreneurs to gain the best ROI possible.

Niko Bonatsos leaves General Catalyst to start a new VC firm focused on young founders and consum...

Decisiveness isn't innate—it's a skill leaders build through emotional steadiness, future vision,...

UK VC in 2026: AI and deep tech boom amid cautious fundraising and a push for liquidity—opportuni...

Discover what early-stage investors really want from first-time founders: clear communication, st...

VCs are kingmaking AI ERP startups with massive early funding, even on low revenue. A new power p...

Gemba Capital's playbook for backing India's fintech and consumer tech innovators at the earliest...